The 252 Scoop

Archives

North Carolina Court Upholds Voter ID and Tax Cap Amendments

SIGN UP FOR OUR NEWSLETTER

North Carolina Court Upholds Voter ID and Tax Cap Amendments |

Judicial Panel Affirms 2018 Constitutional Changes Amid Ongoing Debate |

A bipartisan three-judge panel has upheld North Carolina's 2018 constitutional amendments requiring photo identification for voters and lowering the state's income tax cap.

The case, North Carolina NAACP v. Moore, challenged the amendments on grounds of racial discrimination.

However, the court found that the plaintiffs failed to demonstrate that the amendments were enacted with discriminatory intent or had a disparate impact along racial lines.

Judges James Gregory Bell, Michael Duncan, and Cynthia Sturges issued the decision after extensive deliberation.

The ruling emphasized that the plaintiffs did not meet the burden of proof required to declare the amendments unconstitutional.

In October 2024, the panel heard arguments regarding the validity of the amendments, which were approved by voters in 2018.

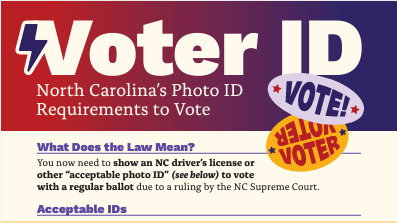

One amendment mandates photo identification for voters, while the other reduces the state's income tax cap from 10% to 7%.

Legal representatives for the state argued that the plaintiffs' claims lacked sufficient evidence and that the amendments were enacted through proper legislative procedures.

Conversely, the NAACP contended that the amendments were products of a legislature elected from racially gerrymandered districts, thus questioning their legitimacy.

This ruling marks a significant development in the ongoing legal discourse surrounding voter ID laws and tax policies in North Carolina.

As the state continues to navigate these contentious issues, the decision underscores the complexities involved in balancing electoral integrity with concerns about racial discrimination and voter suppression.

Community reactions have been mixed.

Supporters of the amendments view the ruling as a victory for election security and fiscal responsibility.

Opponents, however, express concerns about potential disenfranchisement and the long-term implications of the tax cap on public services.

As North Carolina moves forward, the conversation around these amendments is likely to persist, reflecting broader national debates on voting rights and tax policy. |